1 (800) 584-0324

When startups raise funding or issue employee equity, they create a capitalization table—commonly called a cap table. This document shows who owns what in the company: founders, employees, angels, venture capitalists, and other stakeholders.

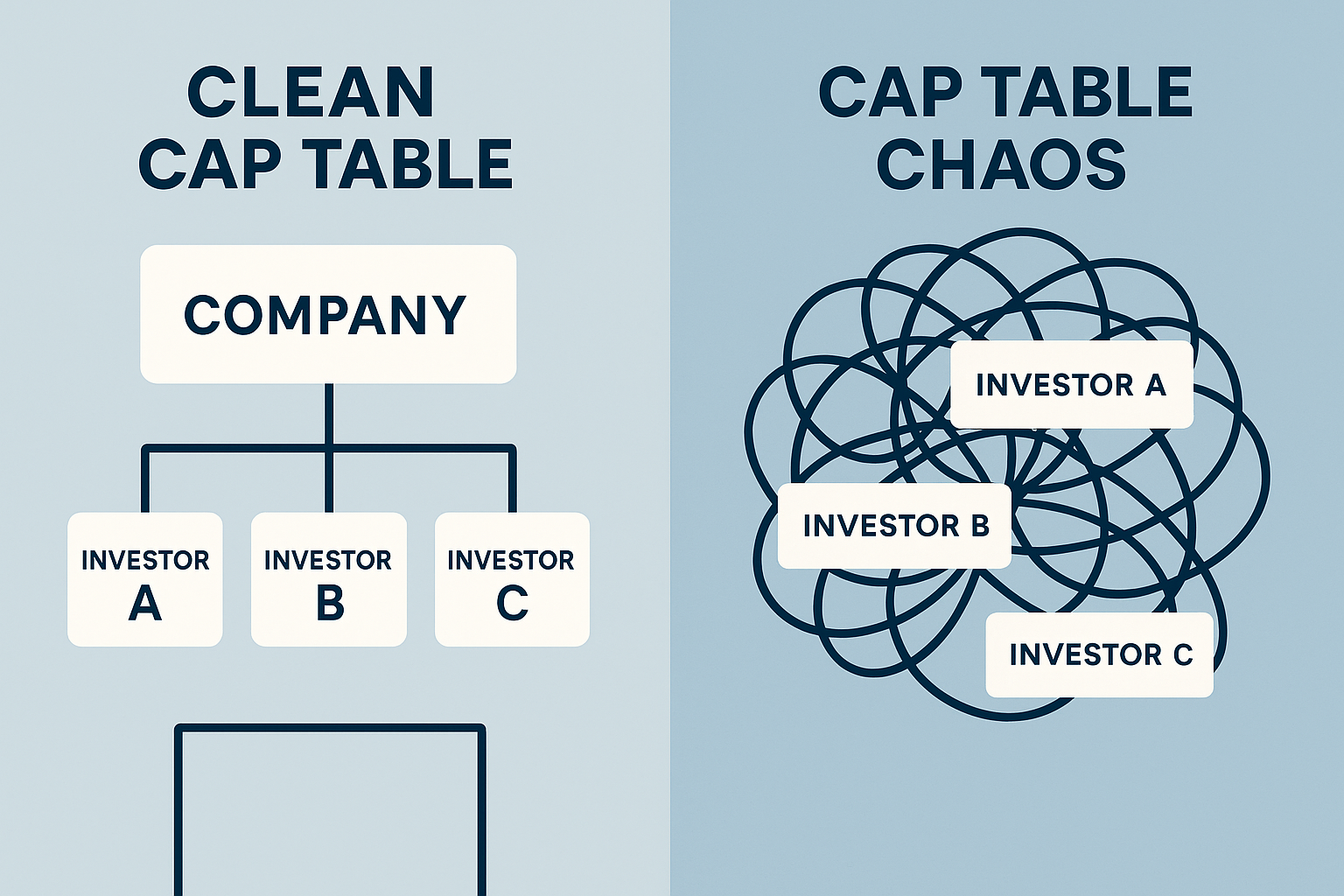

For early-stage companies, cap table management often gets overlooked. But investors scrutinize it closely. A messy, outdated, or unclear cap table can scare off potential backers—while a well-managed one signals professionalism and readiness for growth.

What Is a Cap Table?

A cap table is a detailed record of a company’s ownership structure. It typically includes:

- Founders’ equity stakes

- Preferred vs common shares

- Convertible notes or SAFEs outstanding

- Employee stock option pool (ESOP) allocations

- Equity held by angels, VCs, or strategic investors

Essentially, it answers: Who owns how much of the company—and under what terms?

Why Capitalization Table Management Matters in Fundraising

- Transparency: Investors need to see a clear picture of ownership before committing capital.

- Avoiding surprises: Unclear equity splits or hidden convertible obligations can derail a deal.

- Employee motivation: A clean stock option pool helps attract and retain top talent.

- Negotiation strength: Founders with organized cap tables show they’re serious about governance.

- Future-proofing: Each financing round adds complexity—good management prevents chaos later.

Common Mistakes Startups Make

❌ Not updating after every round or option grant

❌ Over-promising equity to multiple advisors or employees

❌ Failing to reserve enough stock for employee option pools

❌ Ignoring the impact of convertible notes or SAFE agreements

❌ Using spreadsheets prone to errors instead of specialized tools

Best Practices for Cap Table Management Startup

1. Use the Right Tools

- Platforms like Carta, Capshare, or Pulley automate updates and reduce human error.

- For smaller startups, structured templates can work—but should be reviewed often.

2. Plan for Employee Equity

- Reserve an appropriate option pool (typically 10–20%) early.

- Communicate clearly with employees about vesting schedules.

3. Model Dilution Scenarios

- Show how ownership changes across funding rounds.

- Avoid unexpected dilution surprises that frustrate founders or investors.

4. Document Every Change

- Keep legal paperwork aligned with the cap table.

- Each SAFE, note, or equity grant should be reflected immediately.

5. Seek Expert Advice

- Work with advisors to ensure compliance with securities regulations.

- A poorly documented cap table can lead to legal complications later.

U.S. vs Canada: Context

- United States: SAFEs and convertible notes are common at seed stage. Investors expect companies to use standardized documents (YC SAFE, NVCA templates).

- Canada: Convertible notes are more typical, though SAFEs are gaining popularity. Stock option tax rules differ, making professional guidance essential.

Example: The Impact of Cap Table Clarity

- Messy cap table: 2 founders, 3 advisors, 10 angels with different note terms, and an untracked option pool → investors hesitate.

- Clean cap table: Clear founder stakes, structured option pool, and standardized notes → investors proceed confidently.

Reference Summary

| Article Point | Supporting Reference(s) |

|---|---|

| Definition of cap table | Investopedia – Capitalization Table Stripe – Cap Tables for Startups Explained Wikipedia – Capitalization Table |

| Professional signal of a clean cap table | Silicon Valley Bank – Understanding Startup Cap Tables |

| Rising complexity & error risk | Wikipedia – Capitalization Table |

Struggling with cap table management for your startup? Agile Solutions helps founders and CFOs in the U.S. and Canada organize equity structures, model dilution, and prepare investor-ready ownership records.

👉 Book a consultation today at agilesolutions.global or email us at info@agilesolutions.global

#CapTable #StartupFunding #EquityFinancing #InvestorReady #SAFEAgreements #FundraisingStrategy