1 (800) 584-0324

Online lending has transformed how businesses access capital. One of the fastest-growing models is peer-to-peer business loans (P2P lending), where individuals or institutional investors fund business loans through online marketplaces instead of banks.

With digital lending markets expected to double by 2026, understanding peer-to-peer business loans is essential for entrepreneurs seeking faster, more flexible financing.

What Are Peer-to-Peer Business Loans?

Peer-to-peer business loans are loans funded by investors (individuals, funds, or institutions) via online platforms. Instead of applying to a bank, you submit your loan request to a marketplace that matches you with multiple lenders willing to fund it.

How it works:

- Application: Business applies via a P2P platform (e.g., LendingClub, Funding Circle).

- Credit assessment: Platform reviews financials, credit history, and purpose.

- Investor funding: Loan request is listed for investors to fund partially or in full.

- Disbursement: Once funded, the borrower receives a lump sum and repays with interest in fixed installments.

Benefits of Peer-to-Peer Business Loans

✅ Faster approvals: Online platforms can approve in days, not weeks.

✅ Flexible amounts: Loan sizes often range from $10,000 to $500,000.

✅ Diversified investor base: Multiple investors share risk, making approvals easier.

✅ Alternative for businesses denied by banks: Broader underwriting criteria.

✅ Competitive rates for qualified borrowers: Often 7–20%, depending on creditworthiness.

Drawbacks of Peer-to-Peer Business Loans

❌ Higher costs for weaker credit: APRs can reach 25–30% or more.

❌ Platform fees: Origination and service fees reduce net proceeds.

❌ Not as established as banks: Less predictable in downturns; some platforms exit the market.

❌ Potential investor risk: If defaults rise, funding availability may tighten.

Peer-to-Peer vs Traditional Bank Loans

| Factor | Peer-to-Peer Business Loans | Traditional Bank Loans |

| Approval Time | Days to 1–2 weeks | 4–8 weeks |

| Typical Loan Size | $10,000 – $500,000 | $50,000 – $5M+ |

| Interest Rates | 7–30% APR | 6–12% (prime + spread) |

| Requirements | Based on credit + platform scoring | Strict credit, collateral, covenants |

| Flexibility | More accessible for SMEs | More rigid, higher rejection rate |

Best Situations for P2P Lending

- Small to mid-sized businesses needing quick funding

- Entrepreneurs with limited collateral but decent credit

- Companies seeking diversification beyond traditional lenders

- Businesses in growth phases that banks view as “too risky”

U.S. and Canada: P2P Landscape

- U.S.: Platforms like Funding Circle and LendingClub dominate the P2P business loan market, offering loans up to $500k. Many cater to SMEs rejected by traditional banks.

- Canada: P2P lending is newer but growing, with platforms like Lending Loop and goPeer offering small business financing directly from investors. Regulatory frameworks are evolving to support safe marketplace lending.

Key Takeaway

The appeal of peer-to-peer business loans lies in speed, accessibility, and flexibility. However, higher costs and platform risk mean P2P works best for businesses that:

- Can’t access traditional bank loans, or

- Need quick funding for growth opportunities.

Featured Image Suggestion

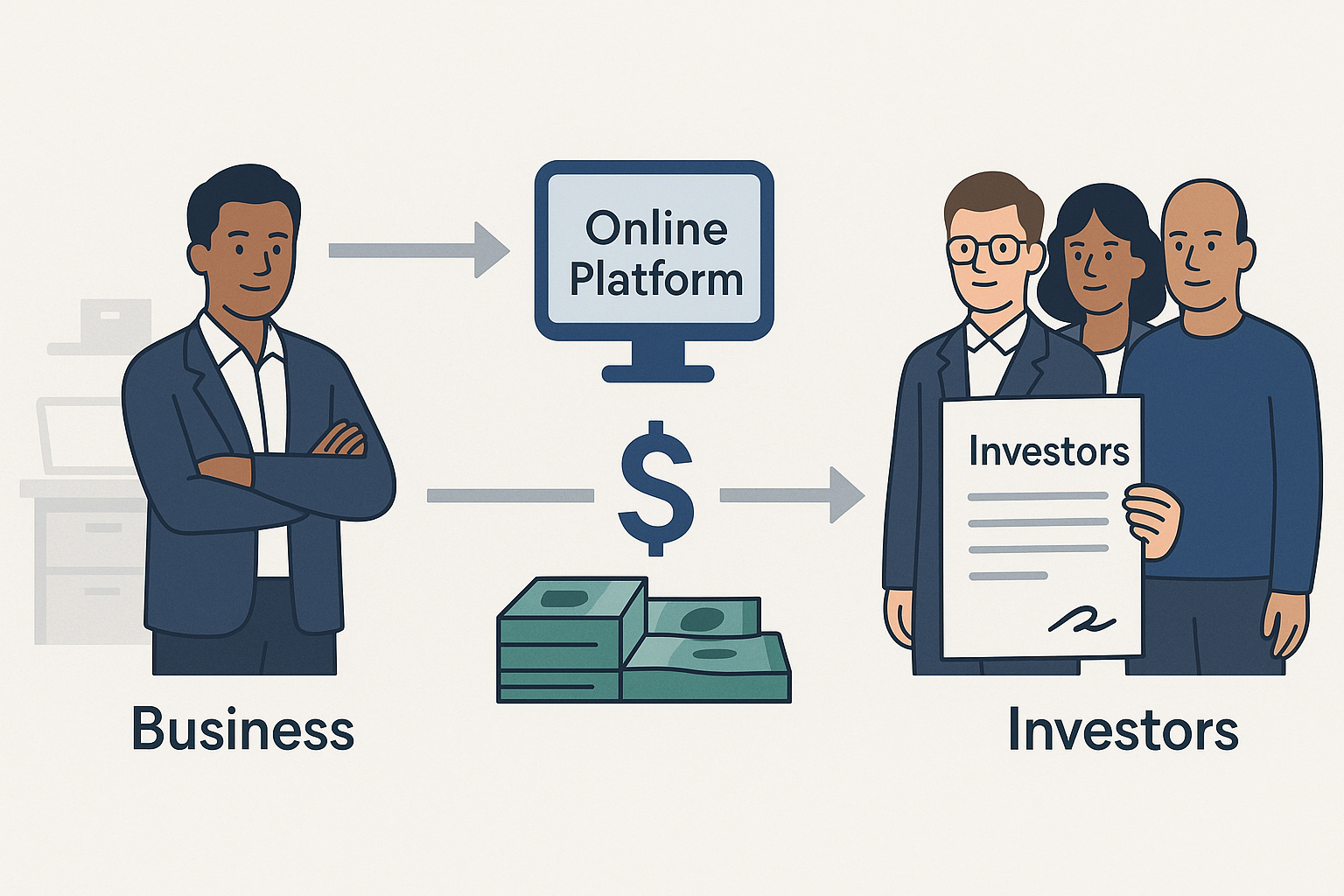

- Idea: A digital marketplace graphic showing a business owner on one side, multiple small investors on the other, with arrows showing money flow.

- Alt text: peer-to-peer business loans — connecting businesses with investors online

- Caption: P2P lending connects entrepreneurs to investors outside traditional banks.

Description:Clean infographic visual showing how online lending platforms bridge businesses and investors.

Curious whether peer-to-peer business loans fit your financing strategy? At Agile Solutions, we help entrepreneurs compare P2P options with traditional loans, private credit, and government-backed programs in the U.S. and Canada.

👉 Book a consultation today at agilesolutions.global or email us at info@agilesolutions.global

#PeerToPeerLending #BusinessLoans #AlternativeLending #BusinessFinancing #P2PLoans #SMBFinance #DigitalLending #PrivateDebt #CapitalMarkets