1 (800) 584-0324

Choosing between a term loan vs line of credit can feel tricky when you’re balancing growth, cash flow, and lender expectations. This guide explains how each product works, what it really costs, and when to use one over the other—so your financing aligns with your operating cycle and strategic goals.

Term Loan vs Line of Credit: Definitions & Core Mechanics

A term loan vs line of credit comparison starts with structure:

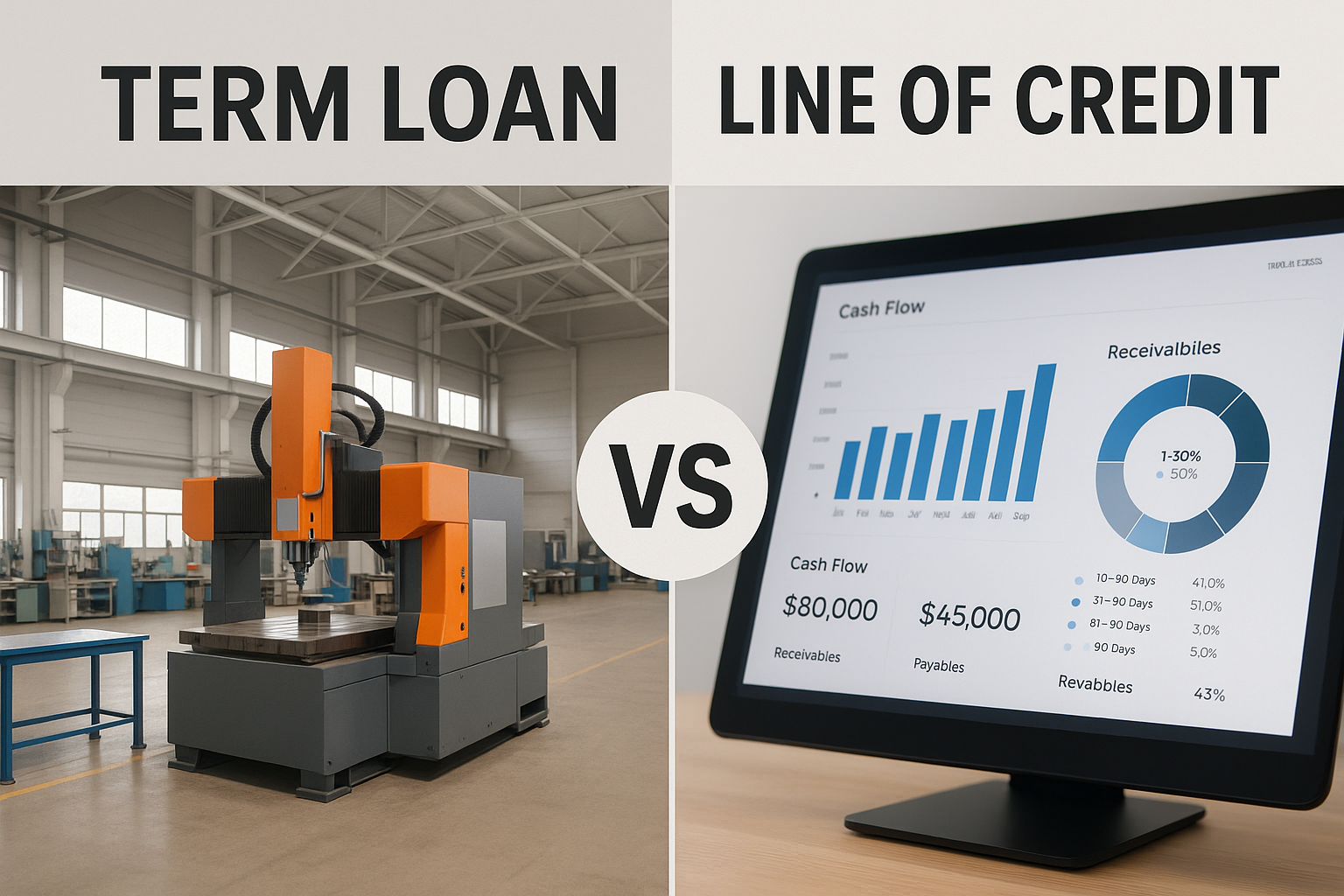

- Term loan: A lump-sum advance with a fixed repayment schedule (monthly or quarterly) over a defined term. Great for one-time investments that produce value over multiple periods—equipment, acquisitions, build-outs, or refinancing higher-cost debt.

- Line of credit: A revolving limit you can draw, repay, and redraw during the term. Ideal for short-term, recurring needs such as payroll bridges, seasonal inventory, or timing gaps between payables and receivables.

At its core, term loan vs line of credit is a trade-off between funding long-lived assets vs working-capital volatility.

The 9 Proven Differences That Matter

1) Use-Case Fit

In a term loan vs line of credit decision, start with the asset’s life. Long-lived assets (machinery, tenant improvements) map to amortizing term debt; variable, short-cycle needs map to a revolver.

2) Cost of Capital

All else equal, term loans often price lower because amortization reduces lender risk. Lines may carry variable rates plus non-utilization fees. When modeling term loan vs line of credit, compare effective APR after fees and expected utilization.

3) Draw Timing & Flexibility

Term loans fund once (or in scheduled tranches). Lines let you borrow only what you need, when you need it—powerful in a term loan vs line of credit choice if cash flows swing within the month or quarter.

4) Collateral & Covenants

Both can be secured or unsecured. However, lines frequently tie to working-capital collateral (AR/inventory) and may include borrowing-base formulas. In term loan vs line of credit underwriting, expect more reporting on a revolver (eligibility tests, aging schedules).

5) Amortization & Cash-Flow Impact

Term-loan principal reduces outstanding balance each period; this improves leverage over time but increases required cash outlay. Lines usually require interest-only with periodic clean-down tests—useful in term loan vs line of credit planning when smoothing intra-month cash.

6) Commitment & Non-Utilization Fees

Lines can charge commitment and unused-line fees to compensate the lender for reserving capital. In a term loan vs line of credit apples-to-apples, include these fees to avoid underestimating true carrying cost.

7) Speed to Close

Revolvers can be faster when unsecured; secured lines need collateral exams. Term loans that require appraisals or legal opinions can also extend timelines. Your term loan vs line of credit timeline depends on collateral complexity and diligence readiness.

8) Future Optionality

Liens and covenants interact differently in stacks. Preserving headroom for equipment purchases or M&A may tilt your term loan vs line of credit selection toward the one that leaves more flexibility for additional facilities.

9) Lender Fit & Market Depth

Not all lenders love every product. In practice, success in term loan vs line of credit sourcing comes from matching your profile (industry, seasonality, collateral) to lenders that specialize in that risk.

The Cost Breakdown: What to Model

When you forecast term loan vs line of credit costs, include:

- Interest rate mechanics: Fixed vs variable (SOFR/Prime + spread).

- Origination & legal fees: Capitalize and amortize to see true APR.

- Non-utilization/commitment fees (lines): Apply your expected usage.

- Prepayment language (term loans): Soft-call or make-whole penalties.

- Collateral & field-exam costs (secured lines): Recurring and upfront.

- Financial covenants: DSCR, leverage, or borrowing-base requirements that may constrain operations.

Internal resource: See how we package lender-ready files and compare options at Agile Solutions (internal link).

How to Choose: A Practical Framework

Use this five-step workflow to resolve term loan vs line of credit quickly:

- Define the need: One-time asset or repeat working-capital swing?

- Map tenor to payback: Asset life → term loan; cash-conversion cycle → line.

- Quantify volatility: If receipts are lumpy, a revolver may win the term loan vs line of credit call even at a higher nominal rate.

- Stress covenants: Model DSCR and clean-down requirements through downside cases.

- Compare all-in cost: Rate + fees + utilization + prepayment = decision logic.

Industry Scenarios (U.S. & Canada)

- Construction & field services: Mobilization costs and progress-billing delays make a revolver practical. Equipment purchases? The term loan vs line of credit answer is typically a term loan or equipment financing.

- Healthcare practices & labs: Lines help with payer-reimbursement lag; imaging equipment suits term debt.

- Manufacturing & distribution: Seasonal inventory spikes favor a line; plant expansions or automation projects point to a term structure.

- Software & digital agencies: Asset-light firms often start with a line for payroll/timing gaps; acquisitions or build-outs shift the term loan vs line of credit decision toward term debt.

Seasonal note (2025 budgeting): As year-end approaches, lenders may tighten or reallocate limits. Submitting a clean package now can accelerate either term loan vs line of credit path.

Documentation Checklist (Both Paths)

For a smoother term loan vs line of credit process, assemble:

- 24 months of financials + YTD statements

- 12–18-month cash-flow forecast and covenant model

- AR/AP aging, inventory reports (for lines)

- Equipment lists and invoices (for term loans)

- Corporate records, insurance, tax status

- Existing debt schedule and lien searches

Common Mistakes to Avoid

- Financing long-lived assets on a line. This can trap working capital and inflate fees; address it in your term loan vs line of credit analysis.

- Ignoring utilization math. Low usage + high unused-line fees may make a term loan cheaper overall.

- Overlooking prepayment penalties. If you expect early payoff, negotiate soft-call protection on the term loan.

- Underestimating reporting load. Borrowing-base compliance can strain lean teams.

Quick Quiz: Which One Fits?

Answer yes or no to each. If you log more yes answers on the left, a term loan likely wins; more on the right, choose the line.

- Is the spend a one-time investment with multi-year benefit? → Term loan

- Do you face recurring timing gaps or seasonality? → Line of credit

- Will the asset generate predictable ROI over time? → Term loan

- Is flexibility to draw/repay/redraw crucial? → Line of credit

- Will unused-line fees outweigh the benefits? → Term loan

- Do you need cushion for payroll and inventory pulses? → Line of credit

This simple exercise brings clarity to the term loan vs line of credit debate.

Helpful Resources

- Explore our Working Capital solutions and case studies at Agile Solutions.

- Loan vs. Line of Credit by Investopedia

- Related reading: Secured vs Unsecured Business Loans.

Ready to compare quotes, covenants, and all-in costs side by side? Agile Solutions acts as your trusted financial partner, structuring lender-ready packages and negotiating across our multi-lender network in the U.S. and Canada.

👉 Book a consultation today at agilesolutions.global or email us at info@agilesolutions.global

#BusinessFinancing #PrivateDebt #CapitalMarkets #WorkingCapital #TermLoan #LineOfCredit #CommercialLending #CashFlow #SMBFinance #MergersAndAcquisitions