1 (800) 584-0324

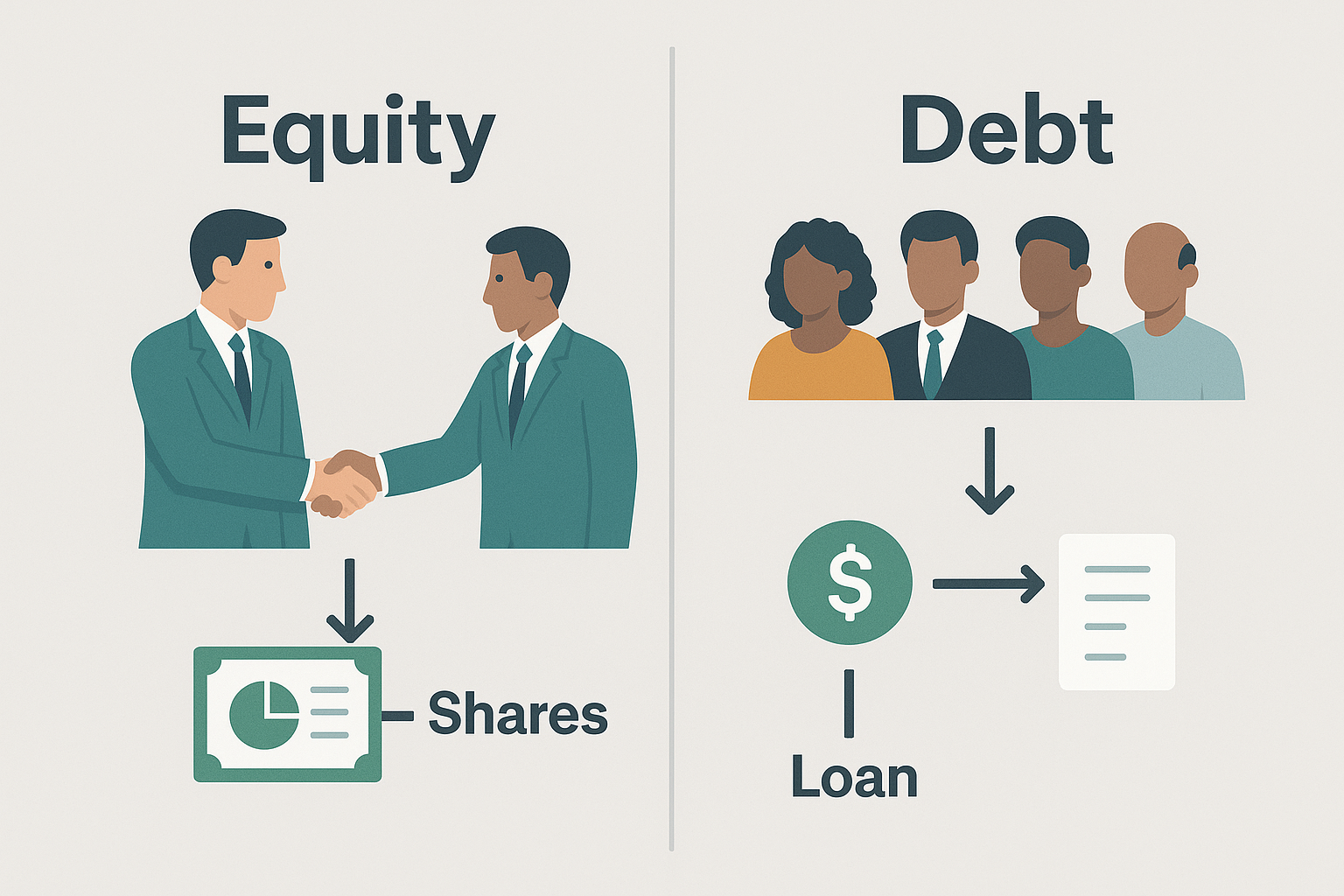

Crowdfunding has moved far beyond Kickstarter perks. Today, founders can raise significant sums online by offering either equity or debt to the crowd. But for entrepreneurs new to these models, the decision of equity vs debt crowdfunding can be confusing.

This guide explains how each approach works, their advantages and drawbacks, and how to decide which is right for your company.

Equity vs Debt Crowdfunding: The Basics

Equity Crowdfunding

- Investors purchase shares in your business through regulated platforms.

- They become partial owners and share in potential profits or exits.

- U.S. examples: StartEngine, SeedInvest, Wefunder

- Canadian examples: FrontFundr, Equivesto

Debt Crowdfunding (a.k.a. Peer-to-Business Lending)

- Investors lend money that must be repaid with interest.

- Functions like a business loan, but funded by many individuals.

- U.S. examples: Funding Circle, Prosper

- Canadian examples: Lending Loop, goPeer

Pros & Cons of Equity Crowdfunding

Pros

✅ Non-repayable capital—no debt burden

✅ Marketing boost—investors often become brand advocates

✅ Access to a broad pool of small investors

✅ Possible stepping stone to VC funding

Cons

❌ Dilution—founders give up ownership

❌ Reporting & compliance requirements

❌ Long-term obligations to many small shareholders

❌ Less appealing for traditional lenders (due to complex cap tables)

Pros & Cons of Debt Crowdfunding

Pros

✅ Retain 100% ownership

✅ Predictable repayment schedule

✅ Can build business credit profile

✅ Often faster than bank loans

Cons

❌ Regular repayments regardless of revenue

❌ Higher interest rates than traditional loans

❌ Risk of default penalties

❌ May require personal guarantees or credit checks

Equity vs Debt Crowdfunding: Side-by-Side Comparison

| Factor | Equity Crowdfunding | Debt Crowdfunding |

| What You Offer | Ownership shares | Loan repayments + interest |

| Remboursement | None | Monthly/quarterly until repaid |

| Investor Role | Shareholder, potential long-term | Lender, no ownership stake |

| Best For | High-growth startups, SaaS, tech | SMEs with stable cash flow |

| Founder Impact | Dilution + governance obligations | Debt service obligations |

Which Option Fits Your Business?

- Equity crowdfunding works best for:

- Startups with high growth potential but limited collateral

- Companies looking to build a community of brand advocates

- Founders willing to trade ownership for capital

- Startups with high growth potential but limited collateral

- Debt crowdfunding works best for:

- Established businesses with steady cash flow

- Owners who want to retain control and avoid dilution

- Companies seeking smaller, short- to mid-term funding

- Established businesses with steady cash flow

U.S. vs Canada: Crowdfunding Landscape

- United States: The JOBS Act legalized equity crowdfunding for retail investors. Debt crowdfunding platforms like Funding Circle thrive alongside equity-based portals.

- Canada: Equity crowdfunding rules vary by province but are growing through exempt market dealers (e.g., FrontFundr). Debt crowdfunding (Lending Loop, goPeer) is newer but provides SMEs with alternatives to banks.

Key Considerations Before Choosing

- What’s more important: preserving ownership or avoiding repayment obligations?

- Do you have steady revenue to cover debt service?

- How will investors view your valuation and growth story (equity)?

Are you prepared for ongoing reporting (equity) or fixed repayment schedules (debt)?

Exploring equity vs debt crowdfunding as a financing path? Agile Solutions helps businesses evaluate crowdfunding alongside loans, private debt, and alternative financing options across the U.S. and Canada.

👉 Book a consultation today at agilesolutions.global or email us at info@agilesolutions.global

#EquityCrowdfunding #DebtCrowdfunding #BusinessFinancing #AlternativeLending #StartupFunding #PrivateDebt #CapitalMarkets