1 (800) 584-0324

For business owners planning succession, selling to employees can be an attractive alternative to selling to private equity or competitors. One of the most effective ways to achieve this is through an Employee Stock Ownership Plan (ESOP).

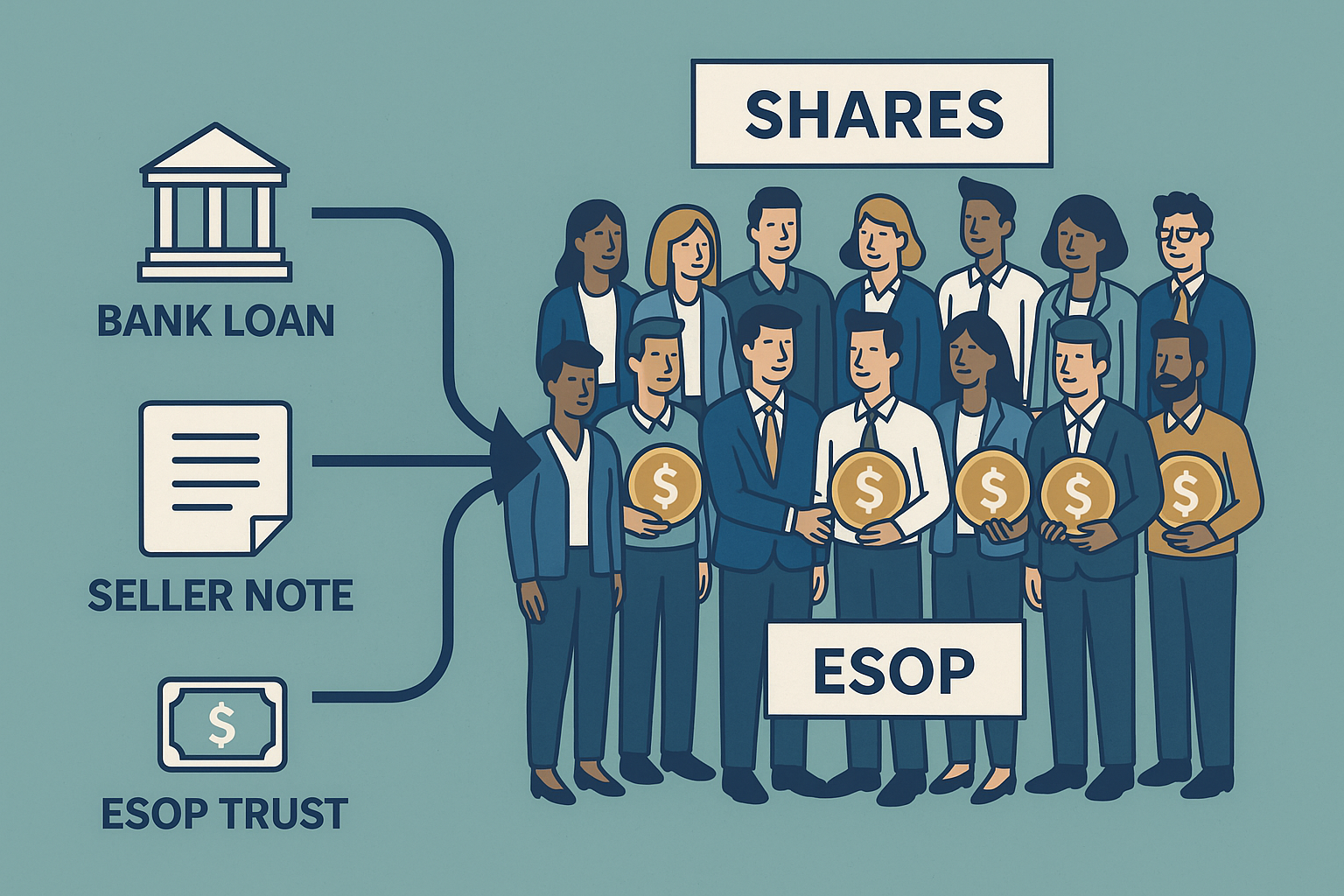

But how does the financing work? In many cases, ESOPs borrow money to purchase shares from the owner—a leveraged ESOP—creating both liquidity for the seller and long-term ownership opportunities for employees.

This article explores how ESOP financing works, its advantages, and what businesses should consider before pursuing this strategy.

What Is an ESOP?

An Employee Stock Ownership Plan (ESOP) is a qualified retirement plan that invests primarily in company stock.

- Employees gain ownership over time through allocated shares.

- The company uses financing (often debt) to buy out an existing owner’s stake.

- Shares are distributed to employees’ ESOP accounts as the loan is repaid.

How Financing Works

1. Leveraged Structure

- The ESOP trust borrows money (from a bank, seller, or both).

- The loan is used to purchase shares from the selling owner(s).

- The company makes contributions to the ownership plan, which repays the loan over time.

- Employees gradually gain ownership without investing personal funds.

2. Seller Financing

- Owners may finance part of the stock option buyout via a seller note.

- Provides liquidity for the seller while reducing the bank’s exposure.

3. Hybrid Financing

- Many ownership plans use a mix of bank loans, seller financing, and sometimes mezzanine capital to complete the transition.

Benefits of Stock Option Financing

✅ Succession solution: Provides a clear path for ownership transition.

✅ Employee motivation: Ownership culture increases productivity and retention.

✅ Tax advantages:

- In the U.S., sellers of C-corp stock may defer capital gains (Section 1042 rollover).

- Contributions to repay Stock Option loans are tax-deductible.

✅ Preserves legacy: Keeps ownership local and rewards loyal employees.

Challenges of Stock Option Financing

❌ Complexity: Requires specialized legal, financial, and tax structuring.

❌ Leverage risk: Debt must be serviced by company cash flow.

❌ Valuation sensitivity: Overpaying for shares can burden the business.

❌ Ongoing compliance: ESOPs require annual valuations and regulatory filings.

Financing vs Other Exit Options

| Factor | ESOP Financing | Rachats par les dirigeants | Private Equity Sale |

| Ownership | Employees (broad-based) | Managers/leaders | External investors |

| Financer | Debt + seller notes | Debt + PE funding | Equity + debt from PE firm |

| Cultural Fit | High—employees stay invested | High—management continuity | Variable—depends on PE strategy |

| Avantages fiscaux | Significant (U.S. C-corps, some in Canada) | Limited | Limited |

U.S. vs Canada Landscape

- United States: ESOPs are well established, with over 6,000 employee-owned companies. Tax incentives make them a powerful succession tool for mid-sized firms.

- Canada: Formal ESOP structures are less common, but Employee Share Ownership Plans and co-op ownership models are gaining traction. Financing often relies on BDC or cooperative lenders.

When to Consider Financing

- Owner wants to exit while preserving company culture.

- Business has strong, stable cash flow to support loan repayment.

- Workforce is engaged and motivated by shared ownership.

- Company valuation supports a fair transaction without excessive leverage.

Reference Summary

| Article Point | Supporting Reference(s) |

|---|---|

| Definition: What Is an Employee Stock Ownership Plan | Wikipedia – Employee Stock Ownership Plan (overview, leveraged structure, succession use) (en.wikipedia.org) Investopedia – Employee Stock Ownership Plan (Structure and financing via borrowing) (investopedia.com) |

| How Leveraged Financing Works | First Bank – A Straightforward Guide to Stock Option Financing (leveraged vs non-leveraged, loan-backed structure, company contributions) (bankatfirst.com) Wikipedia – Employee Stock Ownership Plan (leveraged loan and repayment) (en.wikipedia.org) |

| Tax & Succession Benefits | Investopedia – Employee Stock Ownership Plan (tax advantages, ownership transition, employee incentives) (investopedia.com) |

| Advantages & Challenges | Wikipedia – Employee Stock Ownership Plan (pros/cons, governance, valuation, compliance needs) (en.wikipedia.org) |

Considering stock option financing as part of your succession plan? Agile Solutions helps mid-market companies in the U.S. and Canada design ESOP transactions, arrange financing, and ensure smooth ownership transitions.

👉 Book a consultation today at agilesolutions.global or email us at info@agilesolutions.global

#ESOP #EmployeeOwnership #SuccessionPlanning #BusinessExit #ESOPFinancing #BusinessFunding #CapitalMarkets