1 (800) 584-0324

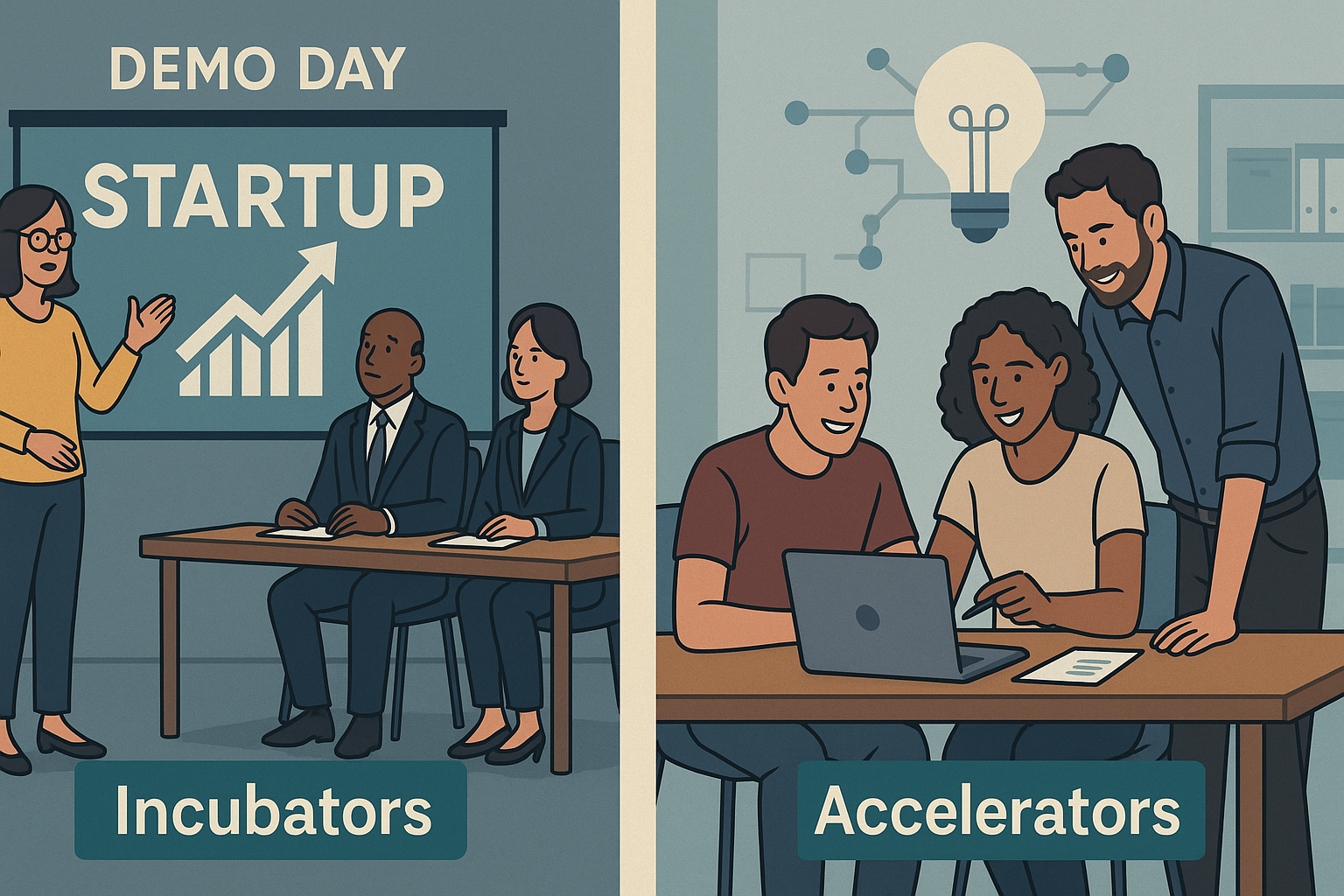

Incubators Accelerators Funding: Do They Really Help Startups Get Funded?For early-stage founders, one common question is: Should I join an incubator or accelerator to improve my funding chances?

Programs like Y Combinator, Techstars, and 500 Global have launched some of the world’s biggest startups. But with thousands of programs available globally, it’s important to understand how incubators and accelerators funding actually work—and whether they’re the right fit for your company.

What Are Incubators and Accelerators?

Incubators

- Long-term programs (6–24 months) focused on nurturing very early-stage startups.

- Provide workspace, mentorship, and business development resources.

- Often run by universities, governments, or corporations.

- Usually don’t invest directly but connect startups to investors.

Accelerators

- Short-term, intensive programs (3–6 months) designed to “accelerate” growth.

- Typically provide small seed funding ($20k–$150k) in exchange for equity (5–10%).

- Culminate in a demo day where startups pitch to investors.

- Run by private funds, VC firms, or global startup networks.

Benefits of Joining an Incubator or Accelerator

✅ Funding access: Accelerators usually provide direct seed capital; incubators help position you for grants or angel rounds.

✅ Investor networks: Strong programs connect you with venture capitalists, angels, and corporate partners.

✅ Mentorship: Guidance from experienced entrepreneurs, investors, and operators.

✅ Credibility & brand: Being “YC-backed” or “Techstars-backed” signals legitimacy.

✅ Community: Peer learning with other founders tackling similar challenges.

Drawbacks to Consider

❌ Equity dilution: Accelerators take equity—sometimes expensive relative to the funding amount.

❌ Time-intensive: Participation can distract from customer acquisition and product development.

❌ Variable quality: Not all programs have the networks or track records of YC or Techstars.

❌ No guarantee of follow-on funding: Demo days create exposure, but capital is not automatic.

Incubators vs Accelerators: Key Differences

| Factor | Incubators | Accelerators |

| Stage | Idea/concept, pre-MVP | MVP/early traction, pre-seed/seed |

| Duration | 6–24 months | 3–6 months |

| Financement | Rarely direct | Yes, usually seed checks |

| Equity | Often none | 5–10% equity stake |

| Focus | Education, development | Rapid growth, investor readiness |

| Outcome | Business plan, MVP, connections | Demo day, investor pitches |

Do Incubators and Accelerators Improve Funding Odds?

- Yes, if you choose the right program. Top-tier accelerators (YC, Techstars, 500 Global) have strong investor pipelines. Graduates often raise follow-on rounds within 6–12 months.

- Incubators can be ideal if you need time and mentorship to validate an idea before pitching.

- Local or niche accelerators (e.g., in fintech, healthtech, or clean energy) can connect you with industry-specific investors.

That said, joining a program is not a substitute for traction. Investors still expect strong teams, markets, and customer validation.

U.S. vs Canada Landscape

- U.S.: Global leaders like Y Combinator (Dropbox, Airbnb), Techstars, and 500 Global drive billions in funding annually. Thousands of regional incubators also exist, often supported by universities or municipalities.

- Canada: Programs like Creative Destruction Lab, DMZ (Toronto), and NextAI are internationally recognized. Provincial governments also fund incubators to stimulate innovation.

When to Apply

- If you’re pre-seed with just an idea → incubator.

- If you’re seed-stage with traction (early customers, ARR) → accelerator.

- If your priority is capital access and investor introductions → accelerator.

If your priority is mentorship and product validation → incubator.

Reference Summary

| Topic | Why It Matters | Reference |

|---|---|---|

| Definition of Startup Accelerators | Short, intensive programs (3–6 months) that provide seed funding and mentorship in exchange for equity. Famous examples: Y Combinator, Techstars, 500 Global. | Investopedia – Startup Accelerator |

| Definition of Incubators | Longer-term programs (6–24 months) focused on nurturing early-stage startups with mentorship, workspace, and investor connections. | Investopedia – Business Incubator |

| Benefits of Accelerators (Funding Odds) | YC and Techstars alumni often raise significant follow-on rounds; accelerators give access to networks, demo days, and brand credibility. | Techstars – What is an Accelerator?, Y Combinator – About |

| Global and U.S. Landscape | YC (Airbnb, Dropbox), Techstars, and 500 Global are top-tier programs driving billions in startup funding. Thousands of regional incubators exist. | Wikipedia – Seed Accelerator |

| Canada Landscape | Canadian incubators and accelerators like Creative Destruction Lab, DMZ, and NextAI are recognized internationally, with provincial support. | Creative Destruction Lab, DMZ Toronto |

Considering an incubator or accelerator to improve your funding chances? Agile Solutions helps startups evaluate equity trade-offs, model dilution, and connect to alternative funding sources across the U.S. and Canada.

👉 Book a consultation today at agilesolutions.global or email us at info@agilesolutions.global

#Incubator #Accelerator #StartupFunding #SeedCapital #VentureCapital #AngelInvestors #EarlyStageFunding