1 (800) 584-0324

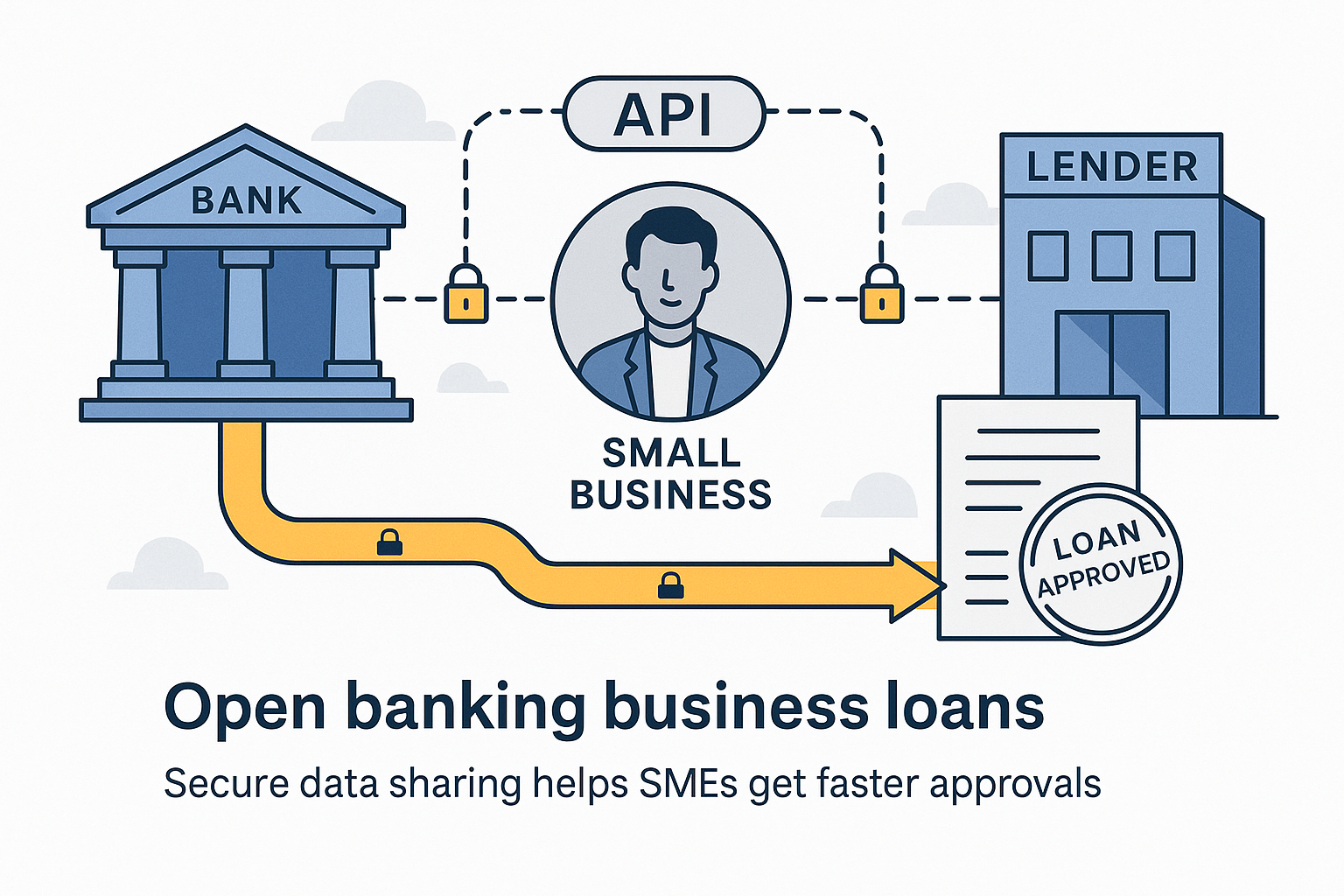

Small and mid-sized enterprises (SMEs) often struggle to secure financing from traditional banks due to rigid requirements and slow processes. Enter open banking business loans—a fintech-driven innovation where businesses securely share their banking data with lenders via APIs.

By enabling lenders to view real-time financial information, open banking can speed up loan approvals, improve underwriting accuracy, and unlock better rates. With API-first lending solutions projected to capture 40% of the SME lending market by 2026, this trend is reshaping how small businesses access capital.

What Is Open Banking in Business Lending?

Open banking allows customers to grant third-party providers (like fintech lenders) access to their financial data through secure APIs.

For open banking business loans, this means:

- Lenders can see cash flow, transactions, and account health in real time.

- Borrowers skip manual uploads of bank statements or tax returns.

- Approvals happen faster and with greater accuracy.

Benefits of Open Banking Business Loans

✅ Faster approvals: Instant access to financial data reduces paperwork and delays.

✅ Better rates for SMEs: Transparent transaction data lowers perceived risk, unlocking fairer pricing.

✅ Inclusion: Businesses with thin credit files but strong cash flow can qualify more easily.

✅ Personalized products: Lenders can tailor repayment schedules to cash flow patterns.

✅ Reduced fraud risk: Direct API data reduces reliance on unverifiable documents.

Challenges and Risks

❌ Data privacy concerns: SMEs must trust platforms with sensitive financial data.

❌ Regulatory complexity: Rules differ by country (e.g., PSD2 in Europe, consumer-directed anking initiatives in Canada, evolving frameworks in the U.S.).

❌ Adoption barriers: Not all lenders or SMEs are ready to adopt API-first systems.

❌ Over-reliance on digital signals: May overlook qualitative factors like management strength.

Open Banking Business Loans vs Traditional Loans

| Factor | Open Banking Business Loans | Traditional Business Loans |

| Application | Digital, API-driven, minutes | Paper-heavy, weeks |

| Underwriting | Real-time cash flow & transaction data | Historical credit & collateral |

| Approval Speed | 24–72 hours | 4–8 weeks |

| Eligibility | Broader, cash-flow based | Narrower, credit-score heavy |

| Risk Management | Lower fraud & default risk via data | Higher reliance on outdated info |

U.S. and Canada: Open Banking Landscape

- United States: Open banking is market-driven, with fintech lenders like Plaid, Brex, and BlueVine leveraging data aggregation. Regulatory frameworks are still developing.

- Canada: The government is rolling out consumer-directed finance (Canada’s version of open banking). Lenders like BDC and fintech providers are beginning to integrate API-based underwriting.

- Global outlook: Europe (PSD2) leads adoption, but North America is catching up fast.

When Open Banking Business Loans Make Sense

- SMEs with steady cash flow but limited collateral

- Startups without long credit histories but with recurring revenues

- Businesses seeking faster approvals for working capital or expansion

Entrepreneurs looking for non-traditional lenders offering flexible terms

References

- Financial Stability Board – Open Banking and APIs: The Impact on Financial Services (2022)

- OECD – Financing SMEs and Entrepreneurs 2023: An OECD Scoreboard

- Bank for International Settlements – Open finance and data sharing: Opportunities and risks for SMEs (2022)

- McKinsey & Company – How open data ecosystems can benefit small and medium-sized enterprises (2021)

- UK Financial Conduct Authority – Open Banking and Open Finance: Regulatory Roadmap (2023)

- World Bank – Open Banking in Emerging Markets: Unlocking SME Financing Opportunities (2022)

Curious how open banking business loans could benefit your company? Agile Solutions helps SMEs in the U.S. and Canada leverage fintech-driven lending options, from working capital lines to flexible growth facilities.

👉 Book a consultation today at agilesolutions.global or email us at info@agilesolutions.global

#OpenBanking #BusinessLoans #FinTech #SMEFinance #AlternativeLending #OnlineBusinessLoans #CapitalMarkets